Wired To Want: Young America’s Battle with Chronic Overspending

And how the 'Bank of Mom & Dad' comes to the rescue

What happens when you spend a lifetime on social media and a society fueled by ‘treat yourself’ culture? A constant seamless click away from your next dopamine high. You become wired, chronically, like a clock wound up to desire the next social pandemonium fad. That’s what we are seeing in our latest research with Axios Vibes, a monthly study to uncover what’s really going on in the minds of American consumers.

The impulse to overspend has become an unconscious habit that surfaces in the back of all interactions, especially among young people.

Let’s look into the data.

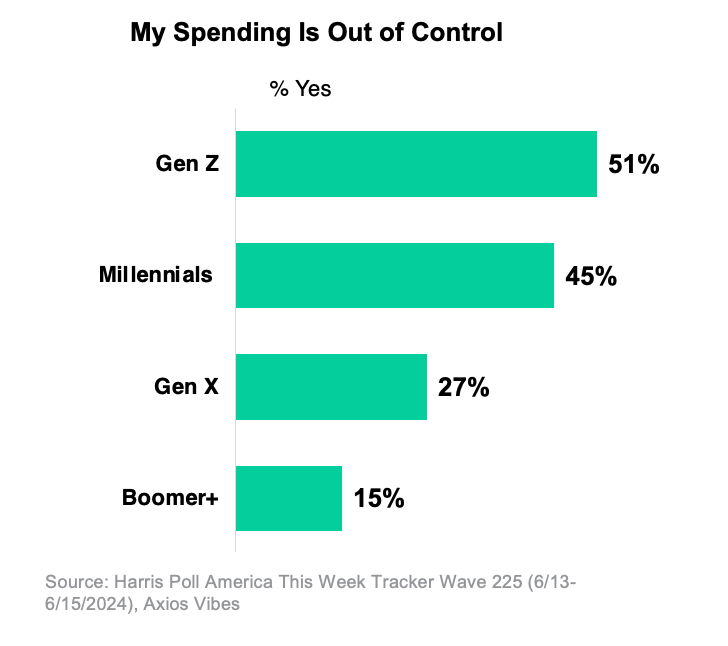

1. Runaway Spending Among Gen Z

Our latest research with Axios Vibes reveals a startling trend: half of Gen Z admits their spending is spiraling out of control. This issue extends to Millennials, with 65% of both Gen Z and Millennials feeling financially strained each month, suggesting a broader generational challenge of financial management.

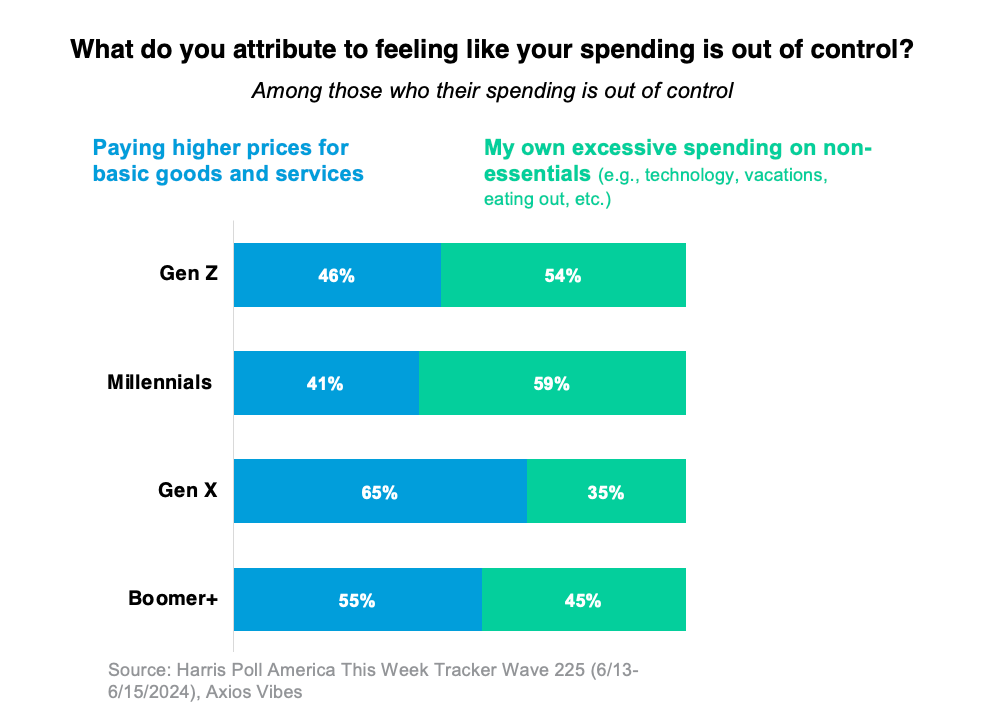

2. Non-Essentials Fuel the Fire

When probing the causes of this financial frenzy, over half of Gen Z and Millennials attribute their uncontrolled spending not to inflation, but to excessive discretionary purchases. This indicates a deep-seated indulgence in non-essential items which exacerbates their financial woes.

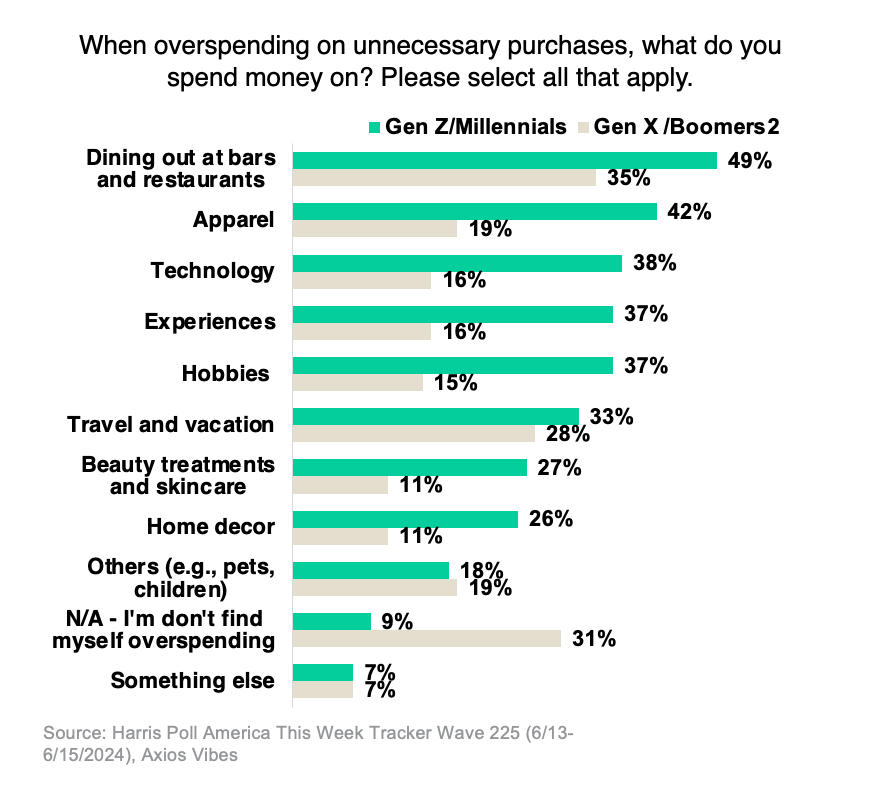

3. The Social Spending Trap

Analyzing spending categories, it’s clear that social dynamics play a critical role. Both generations spend significantly more than older cohorts in areas linked to social engagement—such as dining, apparel, technology and experiences. This pattern highlights the impact of social interactions and the desire to fit in or stand out on spending behaviors.

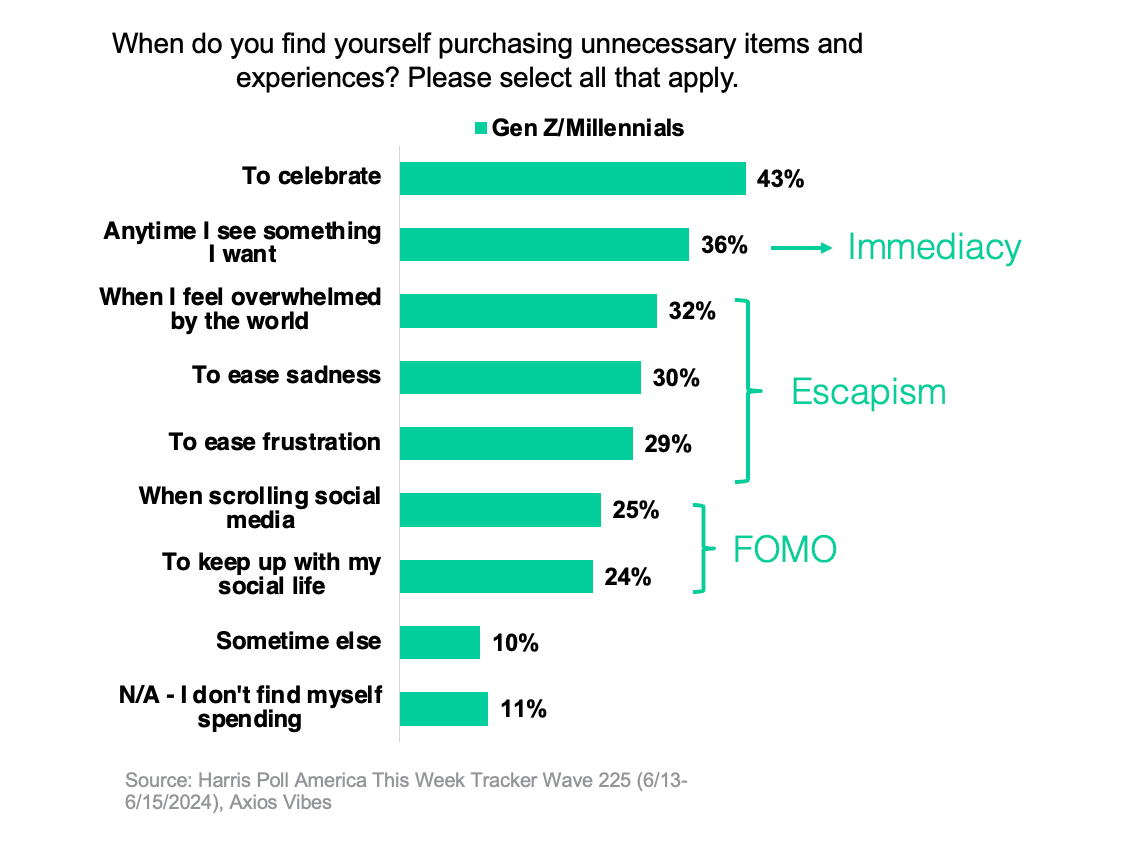

4. Wired for Want, Persistent FOMO

The Fear of Missing Out (FOMO) is not just a fleeting social media buzzword but a fundamental aspect of our psychological makeup, often exploited by today's digital platforms.

Moreover, 38% of young adults openly acknowledge that their excessive spending is fueled by FOMO. They see their friends and influencers enjoying exotic vacations, trendy clothes, and an endless stream of experiences, all curated and shared across social networks, which only deepens their need to keep up. This digital showcase creates an illusion of a constantly exciting lifestyle that is hard to resist or opt out of without feeling isolated or out of touch.

This FOMO-driven consumption is problematic not only because it leads to financial imprudence but also because it fosters an environment where personal value is measured by material achievements and social validations rather than personal fulfillment. This has always been a constant struggle in consumption based society (e.g., keeping up with the Jones) but social media has added a flywheel component behind it. The challenge is significant, as it ties into the very wiring of our social behaviors and the human need for belonging and approval, now magnified and monetized by platforms that understand and leverage human psychology to keep users engaged and spending.

38% of Gen Z and Millennials admit “I know I'm spending too much because of FOMO (Fear of Missing Out)”

5. The Bank of Mom & Dad: Short-Term Relief, Long-Term Reliance?

The reliance on parental financial support has become a stark reality for many young Americans, with over 60% of Gen Z and a third of Millennials depending on the 'Bank of Mom and Dad' to manage their excessive spending habits.

This financial dependency often stems from the pressure to keep up with non-essentials that blow their monthly budgets. 65% of overspending young adults acknowledge that their financial overspending is sustained by parental safety nets, inadvertently fostering what experts term 'delayed adult syndrome,' where financial autonomy is continuously postponed.

This dependency cycle not only delays financial independence but also perpetuates a culture of immediate gratification, underpinned by a safety net that may not always be available.

What to consider

Reported by CNN, US household debt hit a high of $17.5 trillion, debt balances increased across the board, with credit card balances rising $50 billion to hit a new nominal high of $1.13 trillion (when adjusting for inflation, balances have yet to surpass the levels seen in 2008).

Chronic overspending is not just a challenge to younger Americans immediate financial health—it also has profound implications for our society as a whole. The issue of increase debt, underscores the necessity of reevaluating and adjusting our approach to financial education and habits across the board.

“Not having FOMO is the single most important financial skill. I think it’s so important that you cannot ever imagine accumulating significant wealth over your lifetime if you are susceptible to FOMO.“ - Morgan Housel

Insights from financial experts like Morgan Housel shed light on critical aspects of this challenge. Housel emphasizes that overcoming the FOMO is crucial for achieving long-term financial stability. He suggests that vulnerability to FOMO can significantly undermine financial health, highlighting an area that urgently needs addressing.

Alongside this, initiatives such as #LoudBudgeting the financial social media trend of the year, showing a emerging desire to fostering financial literacy and responsible spending among young Americans. These movements provide transparent, in-your-face strategies that can help young people break free from the cycle of spend-and-regret, suggesting a hopeful path forward.

Addressing these challenges requires a collaborative and comprehensive strategy, that lives outside of the traditional financial literacy space. Creating supportive environments and cultural norms that encourage sustainable spending habits are essential steps. Moreover, fostering a cultural shift towards valuing long-term financial health over immediate gratification is crucial.

Shout out to Jacklyn Cooney and John Gerzema, for leading this report!

3 Links

$1 billion gift to make Johns Hopkins medical school free for most (Thanks Mike :) Washington Post)

Gen Zers and millennials are 'quiet vacationing' during 4th of July week instead of taking PTO (CNBC)

Curiosity is contagious; if you like this newsletter, please share it!!

Penned by Libby Rodney and Abbey Lunney, founders of the Thought Leadership Group at The Harris Poll. To learn more about the Thought Leadership Practice, just contact one of us or find out more here.